Why Every Health Plan Needs to Update its Medicare Advantage Member Retention Strategy

Of all the trends impacting health insurance companies that offer Medicare Advantage (MA), four stand out as being critically important issues that require health plans to better address member retention.

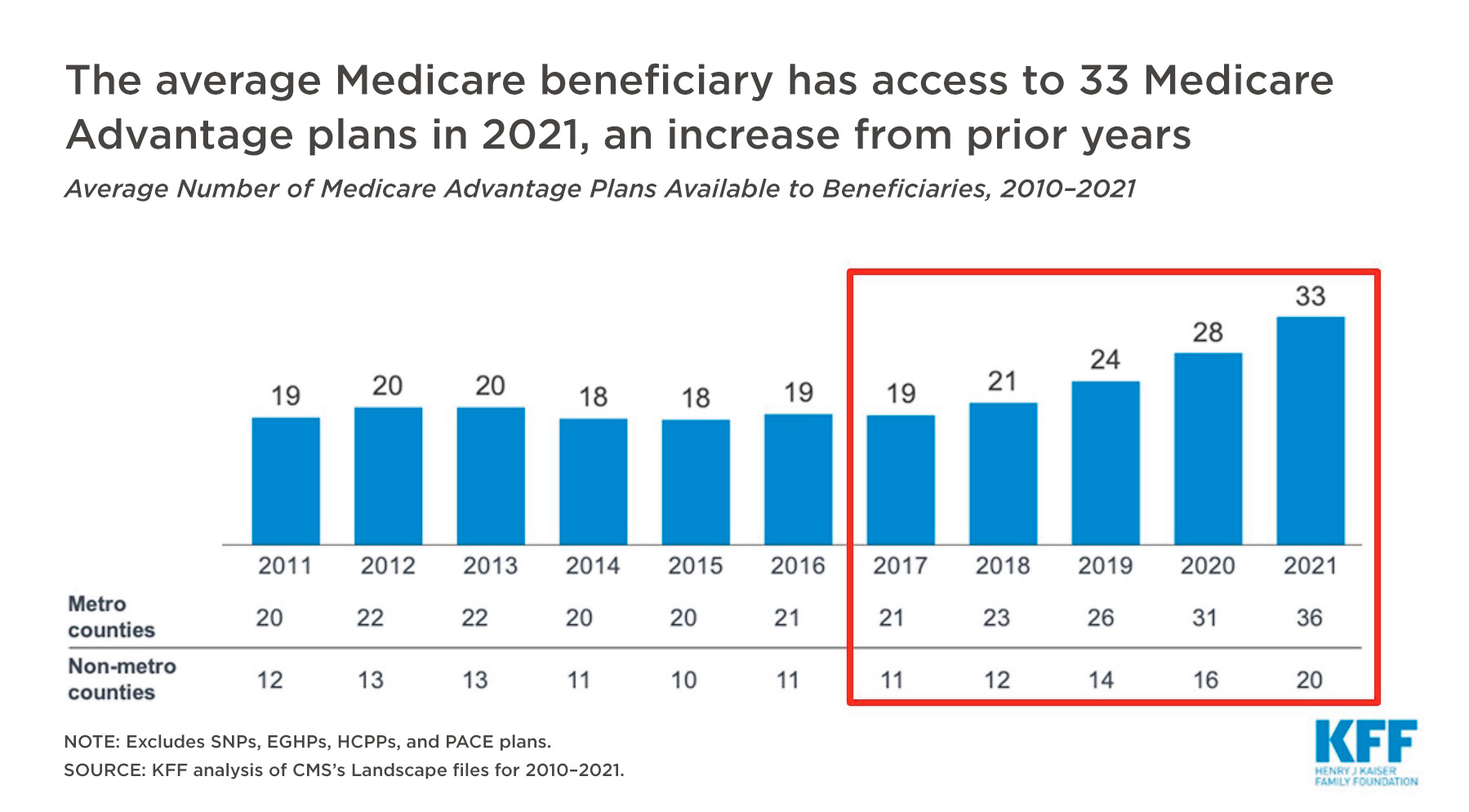

1. Increased Competition

According to the Kaiser Family Foundation, competition from health plans offering MA to eligibles has nearly doubled during the last five years. As shown below in the KFF published findings, there are, on average, 33 MA plans available to beneficiaries compared to 19 plans just five years earlier. This nearly 56% increase in options is extremely challenging for established health plans looking to maintain their market share.

It’s not surprising then that health plans have shifted budget dollars to retention strategy and execution in the wake of this rapid growth in competition. However, as the doctors advise, all things in moderation. Forbes contributor and customer experience futurist Blake Morgan cautions against assuming everything in the industry is still as it once was. She warns that too many companies fixate on the notion that it costs 5X to gain a customer than to retain one. This thinking distracts from what really matters—connecting with customers and delivering value.

To support this thinking, health plans should put together marketing and outreach budgets based on informed strategic decisions that consider both a customer’s lifetime value (CLV) and a balance of acquisition and retention.

Blake Morgan, “Does It Still Cost 5x More To Create A New Customer Than Retain An Old One?”Knowing how much your customer is worth can help you make smarter, more accurate investments in your relationships.

2. Low Net Promotor Scores (NPS)

Historically, the health insurance industry has struggled to achieve high NPS rankings. A recent NPS benchmark study found health plans are near the bottom, just above cable TV services.

What does this mean for an individual health plan brand? Consumers are likely already primed with either a sense of apathy or negative feelings toward health insurance institutions. To turn them into committed, satisfied members, health plans must prioritize the member experience. The member experience must become everyone’s responsibility. Building relationships should be an integral part of how health plans interact with and serve members—ultimately helping plans gain favor and increase their NPS.

3. Proliferation of 5-Star Plans

In addition to more insurance plans being available, there has also been an uptick in the number of options designated with 5-star ratings. In just two years, the number of Medicare eligibles who live in a county where at least one 5-star plan exists has nearly doubled from about 20 million in 2021 to 38 million in 2023.

In 2023, 38 million Medicare eligible live in a county where at least one 5-star plan exists.

In addition to growing in accessibility, 5-star plans are also influencing MA shopping with their unique marketing privileges. During lock-in, 5-star plans can market and enroll members while others cannot. This advantage means plans below the 5-star ranking must do what they can to combat rapid disenrollment—and 5-star plans need to make the most of this exclusive opportunity.

4. Commoditization of MA

How health plans are marketed and shopped for is evolving. Each year, consumers are better informed and savvier with navigating the complexity of offerings to compare costs and benefits. Plans have to offer the benefits members are looking for—and be sure those offerings are easy to find.

Two of the most sought-after benefits are dental and flex spending options. The Part B giveback also is a significant draw that encourages members to switch plans.

It’s important to maintain clear communication with members that demonstrates everything your health plan offers to stay competitive.

How Health Plans Can Respond: Hallmark Cards

Through more than a century of being there for consumers during life’s most important moments, Hallmark has earned its reputation for being relationship experts. We help health plans increase member experience and satisfaction, deter shopping and improve retention—all through the power of an unexpected Hallmark card.

MA members are bombarded with marketing material and too many organizations overlook the importance of creating an experience that feels personal. A warm and friendly outreach will humanize your institution and create heartfelt, emotional connections. Hallmark cards provide unique opportunity to make a difference and strengthen connections for MA members.

89% of Hallmark card recipients give the highest possible satisfaction rating on surveys.

From an extensive 5-year study, one Hallmark client found retention rates were 10% higher when they mailed Hallmark cards.

Hallmark’s experience working with nearly 50 health plans helped us develop tried and tested strategies for member engagement to improve retention. Here are four of the top priority tactics that we recommend clients execute to deliver results.

Pre-AEP

This is a critical time to connect emotionally with your MA members and show them you care. By mailing a Hallmark card before AEP, you can reaffirm a member’s decision to select your plan and make them feel confident in their choice to reenroll.

Deft Research’s Medicare Shopping & Switching Study suggests that connecting early is key, as many switchers only decide to change plans after seeing advertisements and ANOC letters.

Positive outreach from a health plan before AEP marketing even begins can reassure members they don’t need to do anything during AEP. This is also a great time to invite them to reach out with any questions by providing a contact phone number, website address or QR code to scan.

Pro Tip: Consider using a pre-AEP mailing as an invitation to a member event—in person or virtual!

Thanksgiving

Another ideal time to create a personal touchpoint with MA members is mid-November. Greeting cards that arrive in-home right around the Thanksgiving holiday are perfect for sharing a message of gratitude and community. Not only do Thanksgiving cards help you beat the holiday rush, but they also reach members at the peak enrollment shopping period.

49% of shoppers during AEP did their shopping between Nov 15 and Dec 5.

At a time when many members may be contemplating switching, a card for this occasion will arrive well before AEP ends to deter shopping.

OEP

Following the reinstatement of OEP, Q1 rapid disenrollment has been an issue for many health plans. Hallmark cards can combat this issue with an early January message. A note of sincere appreciation for the trust members have placed in you will make members less inclined to entertain the numerous solicitations other plans may send during OEP.

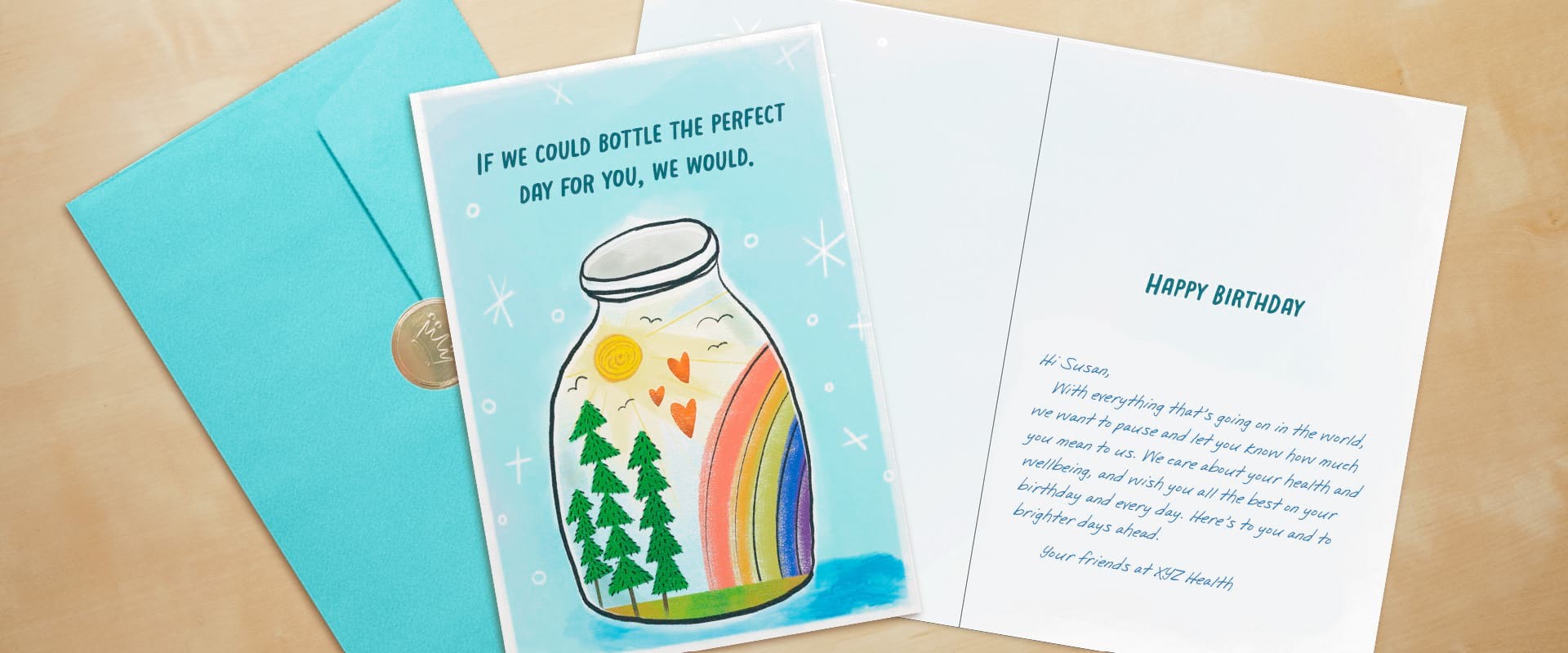

Birthday

With Hallmark Business Connections, your health plan can let every member know you’re thinking about them on their special day—for $1 or less. The premise may seem simple, but the emotional impact a birthday card can have on MA members is significant.

Hallmark Card RecipientThis is the only birthday card I received this year, and it means a lot!

Our health plan clients share that in response to birthday mailings, their member experience teams receive calls, letters and even greeting cards from members letting them know how much they appreciate the card. Testimonials like those below demonstrate the power of Hallmark cards to make someone’s day and even increase business outcomes, such as customer satisfaction, NPS, CAHPS scores and retention.

Hallmark Card RecipientYesterday was a long day, but in the middle of my long day I received the Hallmark card and was so touched it brought tears to my eyes.

Hallmark ClientWe are starting to hear from the customer service team that members receiving the Hallmark cards are expressing their gratitude on many inbound calls. Big thanks to you and the Hallmark team for working with us in this effort.

Undoubtedly, health plans are facing multiple industry trends that require adjustments to member retention strategies. To endure these market challenges, organizations must focus on relationships and prioritize member experience. Let us help you deepen connections in personal, emotional ways through Hallmark cards.

If you are interested in seeing case studies or learning how Hallmark Business Connections can support your organization please contact Jada Sudbeck, VP of Sales and Marketing, at Jada.Sudbeck@Hallmark.com.

In this Article

-

1. Increased Competition

-

2. Low Net Promotor Scores (NPS)

-

3. Proliferation of 5-Star Plans

-

4. Commoditization of MA

-

How Health Plans Can Respond: Hallmark Cards

-

Pre-AEP

-

Thanksgiving

-

OEP

-

Birthday

Similar Articles